Capital and capacity for growing enterprises, with a focus on Africa.

Africa's SME financing gap exceeds $330 billion. Since 2004, GBF has worked to close it.

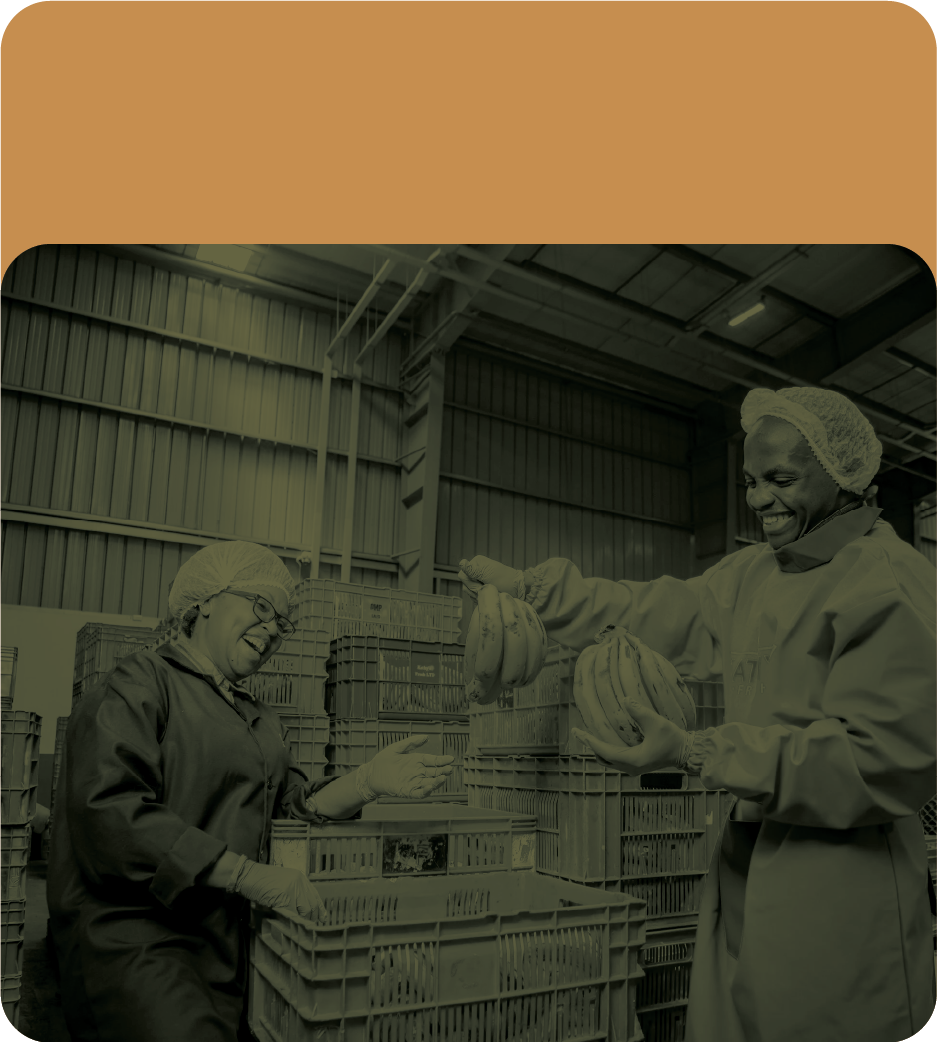

We provide patient capital and hands-on technical assistance to enterprises in agriculture, manufacturing, and climate solutions across Eastern Africa, with particular attention to women and youth-led businesses. Repayments are recycled into new investments, compounding impact over time.

Our Model

Capital alone does not build businesses. We combine financing with hands-on support so enterprises can grow and stay strong.

Our Impact

When a business grows, the people connected to it benefit: workers earn wages, farmers and suppliers get paid, consumers access affordable products, and families gain stability. That is how our investments translate into impact.

Our Work

Investment Management

We deploy capital directly into enterprises across East Africa, focusing on agriculture, manufacturing, and climate solutions. Our portfolio companies are ready to scale but overlooked by traditional lenders.

Program Management

We design and manage lending programs with partners, reaching thousands of entrepreneurs who need smaller amounts of capital to grow

Technical Assistance

We work alongside the businesses we finance on financial systems, operations, governance, and market access. Support continues until the business can stand on its own.

A message from our founder

"The entrepreneurs building Africa's economy deserve more than handouts or predatory loans. They deserve real partnership. That belief has grown into hundreds of businesses, thousands of jobs, and millions of lives improved. Our mission has not changed: the best investments are not just financially sound, they are deeply human."

— Harold Rosen, Founder